Swiss business positive in the face of gloomy expectations beyond their borders

Some signs of hope and a subtle, informed take on what could come next in the Brexit saga

But in the UK and the Netherlands, uncertainty is rising

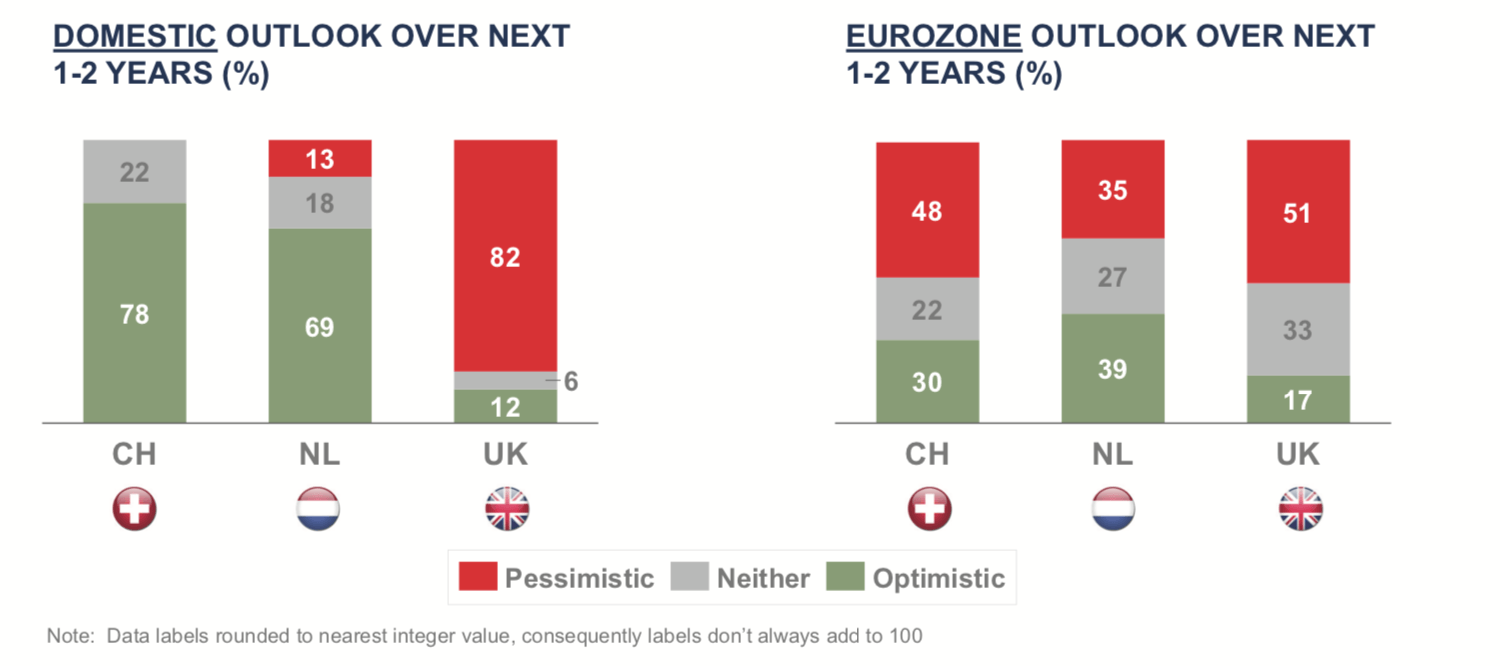

We are entering an age of renewed uncertainty, according to Eden McCallum’s international survey of Swiss, Dutch and UK business leaders. While anxiety might have been expected among British businesses in the midst of Brexit chaos, nervousness about the wider global situation affects all. In Switzerland, our mini-poll indicated:

- 78% of Swiss respondents were optimistic about the next couple of years in the domestic economy

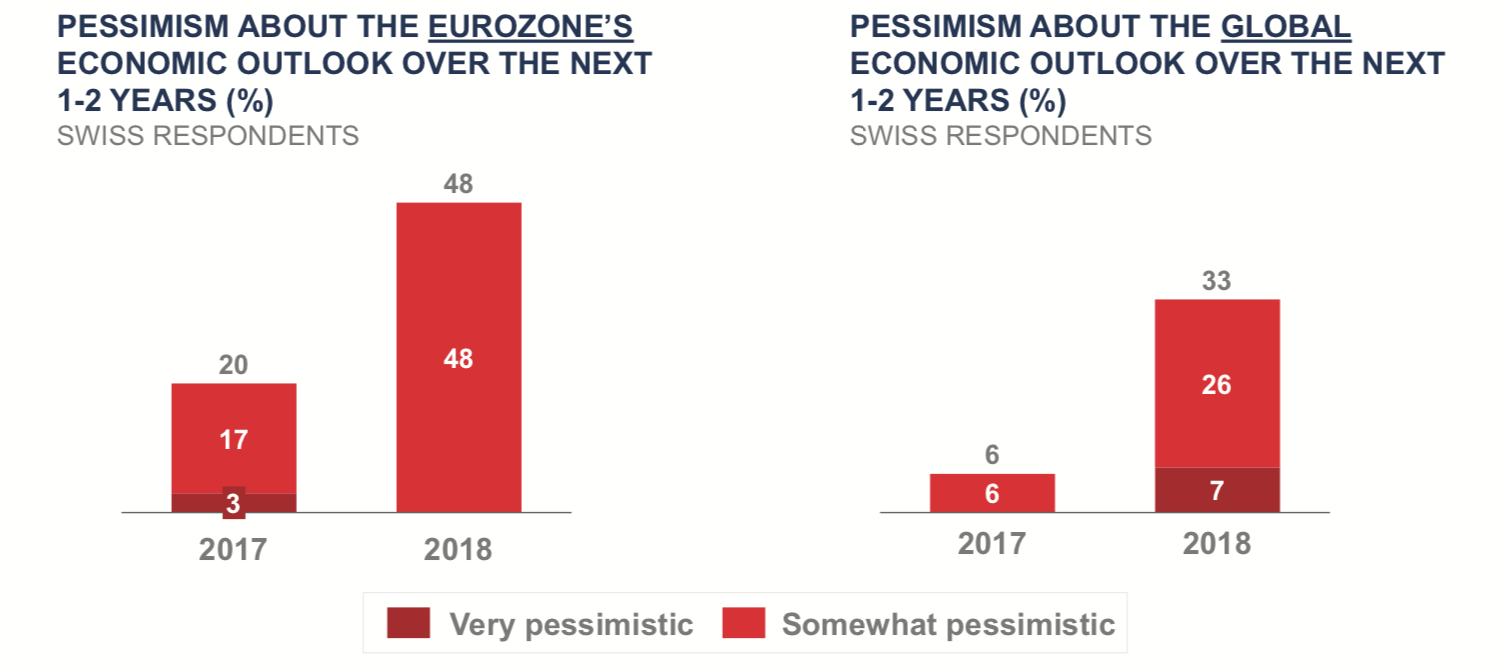

- But at the same time 33% are pessimistic about the global economic outlook, up from just 6% last year

- Only 52% of the Swiss business leaders surveyed now think Brexit is very likely to happen, down from 74% a year ago

Abroad, 35% of Dutch respondents are pessimistic about prospects for the eurozone in the next 1-2 years, up from only 7% a year ago. In the UK, 82% of respondents are either “pessimistic” or “very pessimistic” about their own domestic outlook over the next 1-2 years; 27% of respondents are very pessimistic (up from 17% this time last year).

In contrast to rising nervousness in UK and Dutch business circles, Swiss businesses are looking forward to 2019 with rather more optimism, according to the Swiss mini-poll. Senior executives at 28 Swiss firms are more hopeful now about the prospects for the Swiss economy than they were in the past two years. But they are concerned that the global economy is about to hit more turbulent conditions.

Outward-looking and international, European and yet not formally in the EU, major Swiss businesses have a unique perspective on the global economy, borne out in this year’s survey findings. While hopes are rising about conditions at home the eurozone is viewed less positively – 48% are now pessimistic about the next 1-2 years, more than double last year’s equivalent figure of 20%.

Further afield, the US is also a greater cause for concern than before. President Trump is now seen as having a bad impact on the global economy by 86%, up from 68% a year ago. 40% now see Trump as being harmful for the Swiss economy, whereas only 29% did this time last year.

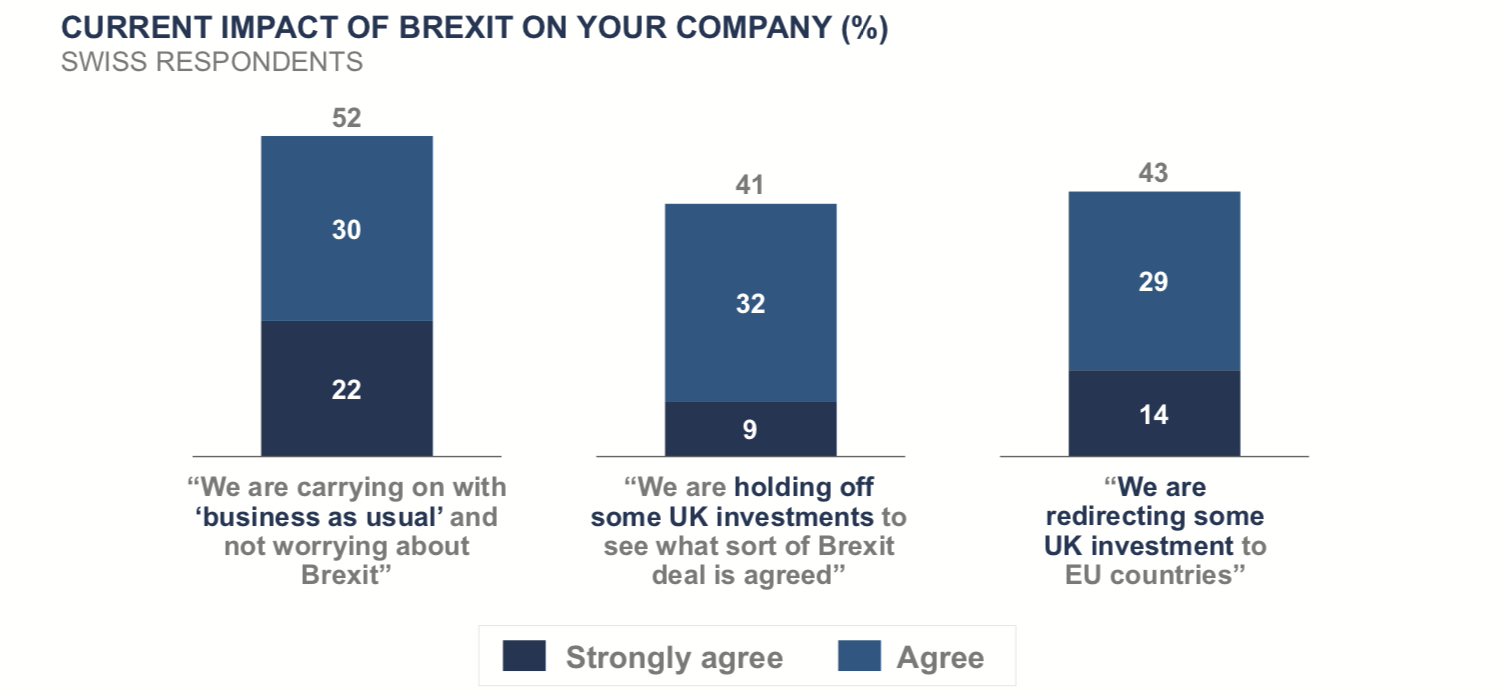

Swiss business’ take on the unfolding Brexit drama is also interesting. While 52% of respondents’ organisations are happily carrying on with business as usual undisturbed by Brexit machinations, 41% are holding back on some UK investment until the situation is clearer, and 43% are redirecting some UK investment to EU countries.

Strikingly, given their special perspective on the matter, Swiss businesses are now far less certain that the UK will be leaving the EU. Twelve months ago 74% of respondents felt it very likely the UK would be leaving, now only 52% do. Only 21% think that another member state will choose to leave the EU in the next couple of years, down from 34% a year ago.

Says Jörg Funk, Eden McCallum Client Director in Switzerland: “The Swiss economy has clearly recovered well from the Swiss Franc shock in 2015, and encouraging signs about business sentiment for the year to come are evident. However, on our doorstep the eurozone is cause for concern, Brexit is a complicating factor – 42% say it will have a bad impact on their company – and anxieties over the US and China are growing. Given the Swiss economy’s strong export focus, there is no room for complacency here.”

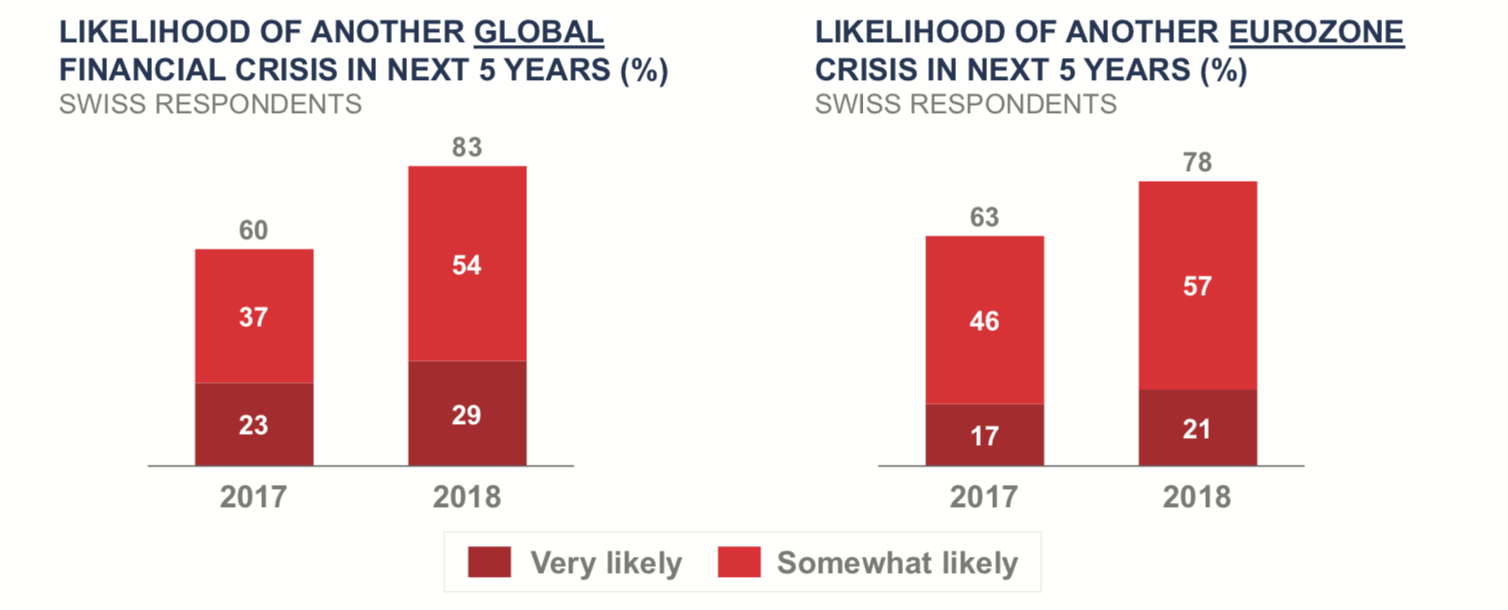

Indeed, Swiss businesses are braced for trouble internationally, according to the survey. 83% think a global financial crisis is likely to emerge in the next five years, up from 60% last year. 78% think a Eurozone crisis is likely in the same timeframe, up from 63% a year ago.

Eden McCallum’s Economic Outlook Survey

Eden McCallum’s survey was conducted online with their clients and other business leaders between 19th and 26th November 2018, and at the same time of year in the previous 5 years. The Dutch poll began in 2014, and the Swiss mini-poll was first conducted in 2016.

In 2018, there were 413 respondents across the three countries (CH: 28, UK: 192, NL: 193). 82% of respondents are Chairs, CEOs/MDs, Board Directors, Divisional Directors, VP/Partners, or Heads of function.