Results of Eden McCallum’s Economic Outlook survey 2015

“China could be the source of a major global financial crisis in the next five years,” says Adair Turner.

Confidence at home, some nervousness abroad – with nerves rising the further east you go. That seems to describe the mood of the 300 business leaders surveyed by management consultancy Eden McCallum in its third annual report into business sentiment at the end of the year.

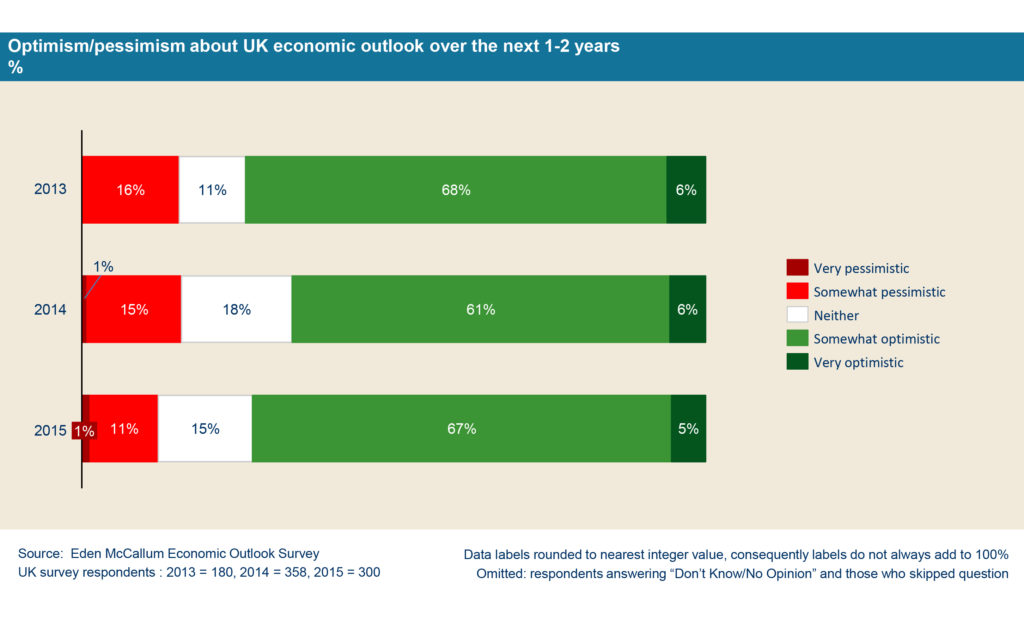

Good news first. Over seventy per cent of respondents are optimistic about the UK’s economic prospects for the next two years – at 72% that figure is five points up on last year.

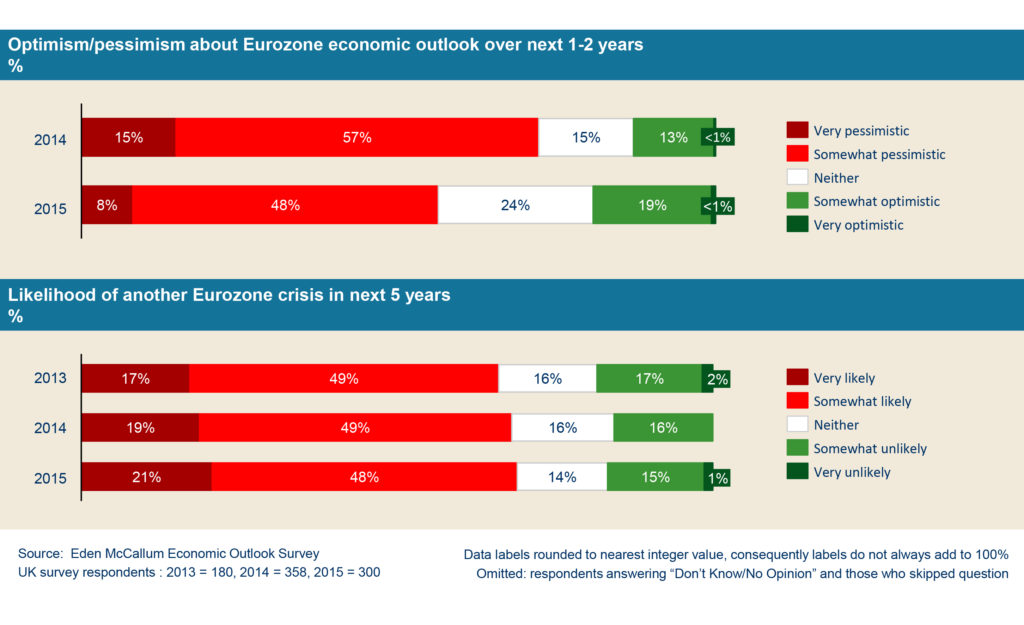

And pessimism about the Eurozone has also declined. At the end of 2014, 72% were pessimistic about the outlook over the next couple of years. Today that pessimism has fallen to 56%. However, a further Eurozone crisis in the next five years is seen as likely by 69%, more or less the same proportion as a year ago.

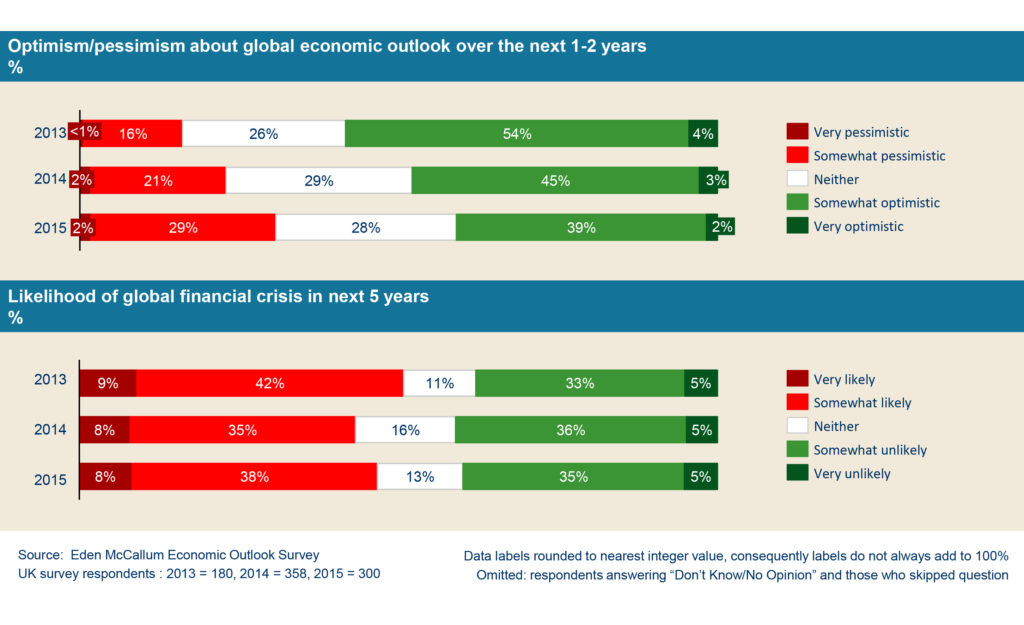

On the global economy feelings are more muted. 41% are optimistic about the next two years, while 31% are pessimistic. There has been a steady decline in sentiment since 2013, when optimists outnumbered pessimists by 58% to 17%.

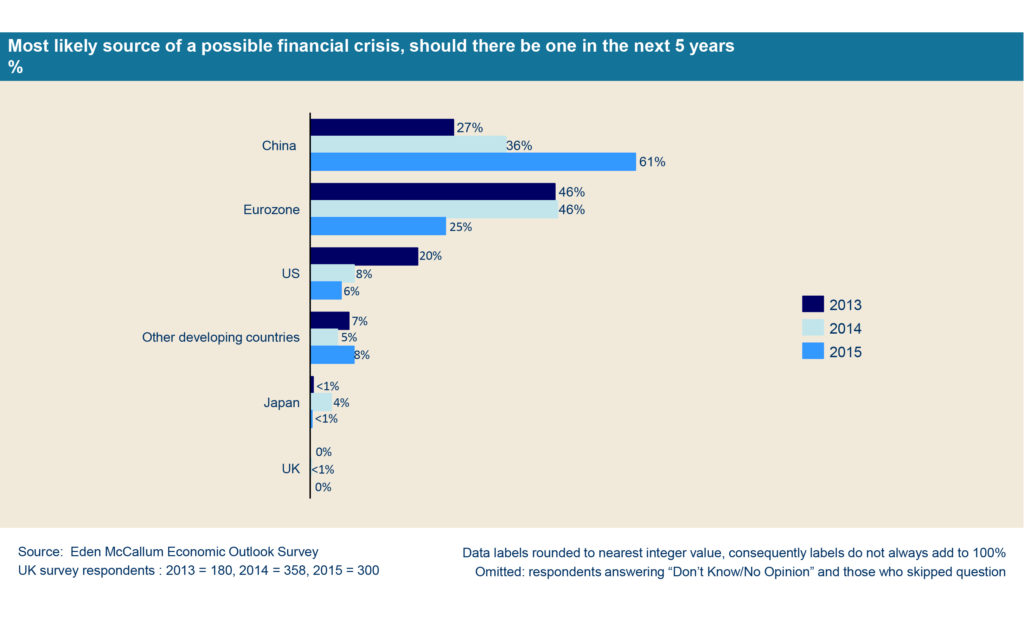

The underlying cause for this nervousness? In a word: China. It is seen as the most likely source of any possible financial crisis in the next five years by 61% of business leaders – almost double the proportion of respondents who looked on anxiously in that direction last year. The Eurozone, by contrast, is now seen as a less likely scene of disaster – down to 25% of respondents from 46% a year ago.

Adair Turner, former chairman of the Financial Services Authority and author of ‘Between Debt and the Devil: Money, Credit, and Fixing Global Finance,’ broadly agrees with most of the views revealed by the survey, but adds a few important caveats of his own.

“It’s noticeable that pessimism about the global economy has increased significantly over the past two years, with the focus of nervousness on China,” he says. “That view is right, I think. There is a slowdown going on there whose impact is hard to determine. Markets ignored it a year ago, but not anymore.”

But are business leaders right to think the UK could ride out any global turbulence? “The drivers of internal demand can probably keep going here even if the rest of the world turns down,” Turner says.

On Europe, however, he is more pessimistic than most respondents. “Europe is running a current account surplus and is vulnerable to a global slowdown,” Turner says. “There is little dynamic domestic demand. Europe is dependent on exports.”

And China does give cause for concern. “The downturn there could be more severe than many realise,” he says. “This will have a further impact on the global demand for commodities. Over the next five years, as China becomes more connected to the global financial system it could be the source of a major crisis.”

Ends

Eden McCallum’s Economic Outlook Survey

Eden McCallum’s survey was conducted online with their clients and other business leaders. Responses were gathered 18-27 November 2015, and at the same time of year in 2014 and 2013.

In 2015 there were 300 respondents to the UK survey. 91% of 2015 respondents were Chairs, CEOs/MDs, Board Directors, divisional Directors, or VP/Partners, within publicly-listed companies (45% of respondents), privately-held companies (46%), state-owned entities (2%) and other types of organisation (7%).