Could the worst be behind us? Dutch business leaders are cautiously optimistic about the economy

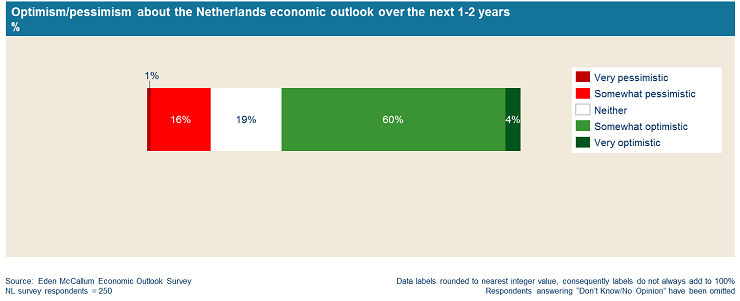

There is some good news: the Dutch business community is hopeful for 2015. The majority of 250 business leaders surveyed by Eden McCallum in the Netherlands are optimistic about the domestic economic outlook over the next couple of years.

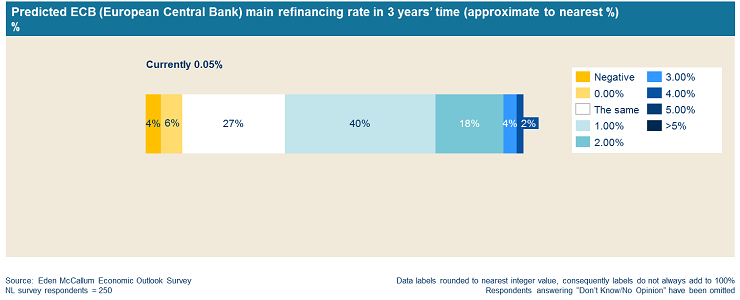

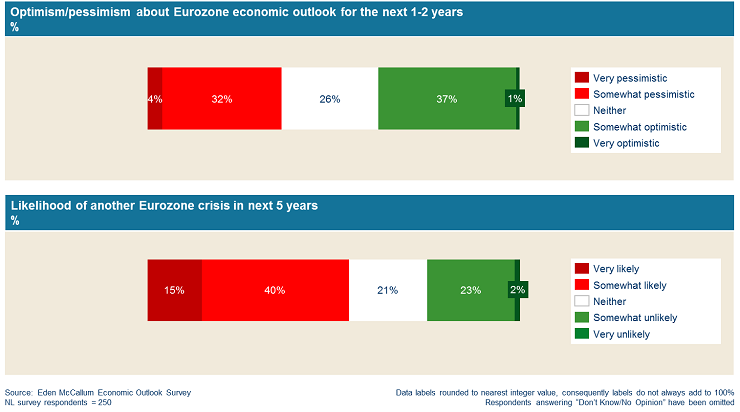

Perhaps this guarded optimism is in some way influenced by interest rate expectations: most (77%) expect the ECB refinancing rate to be at or under 1% in 3 years’ time. But views are pretty evenly balanced on the immediate outlook for the Eurozone. A majority (55%) believe there is a chance of another Eurozone crisis in the next 5 years.

Bas Alblas, CEO of Lamb Weston, the potato products manufacturer, says that, compared to the last five to six years, current conditions are slightly more encouraging. “The worst is probably behind us” he says. “People have swallowed a lot of pain and it is only natural to look forward to something better” he adds.

“For me the bigger question is: what will be happening five years from now?” Alblas continues. “If banks continue to be reluctant to take risks and think only short term, that will have an impact on entrepreneurship. Getting financing can still be a problem in the Netherlands. And we need consumer activity at home, as well as abroad.”

Roland van Dijk, Global Director Corporate Development at Arcadis, the construction consultants, says that, as an outward-looking trading nation, the Netherlands will be more influenced by developments in international markets. “The world economy does seem to be perking up a bit … we have had six difficult years, but the sky has not fallen in. There is some way to go, but I think we can be optimistic” he says.

Some business leaders are perhaps a little more guarded about economic prospects, on the domestic front at least. Berno Kleinherenbrink, CEO of LeasePlan Nederland NV, market leader in the fleet management business, says that the employment numbers in the Netherlands are not entirely encouraging.

“If you look at the number of layoffs already announced, and those still to come, you would have to be a bit less hopeful about the Dutch situation. Consumer spending has gone up just a bit in recent times, which is a good sign, but to some extent we are seeing ‘jobless growth'” he says.

While some LeasePlan clients are placing healthy orders for 2015, indicating some optimism on their part, “we are definitely not getting carried away” he says.

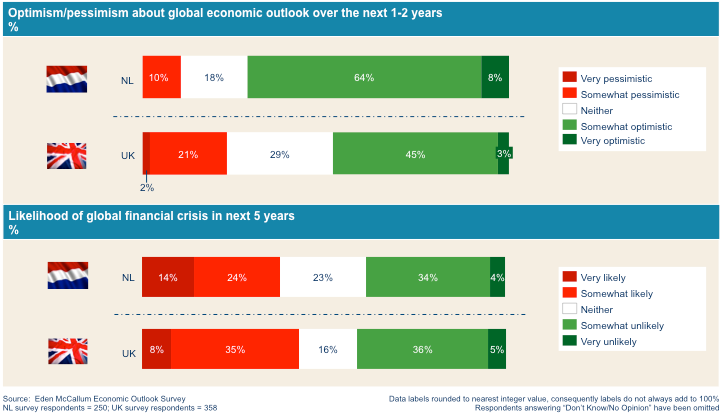

As regards the global situation, Dutch sentiment is on the whole positive, with 72% of respondents optimistic about the next 1-2 years. This is markedly more positive than the UK view, uncovered by a similar Eden McCallum survey: there, only 48% were positive. On the chances of another global crisis in the next 5 years, Dutch optimists are evenly balanced with the pessimists.

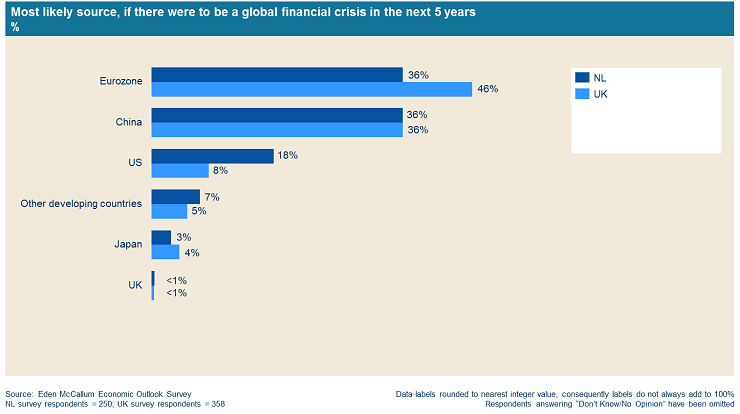

China and the Eurozone are seen as the most likely sources of a global financial crisis in the next five years (36%), whereas Dutch respondents have almost twice as much concern about the US as the Brits do (18% against 8%).

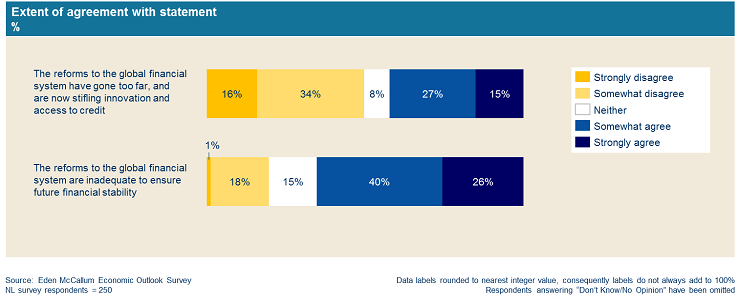

Two thirds of Dutch business leaders believe existing reforms to the global financial system are inadequate to ensure stability; conversely, over 40% say reforms have gone too far.

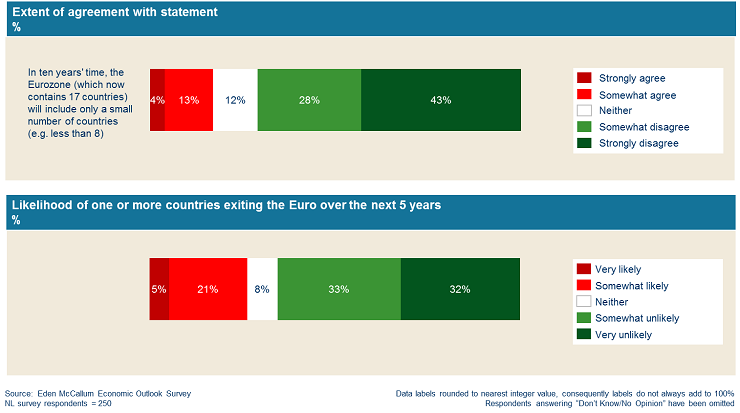

Perhaps unsurprisingly, on Europe the Dutch are much more positive than the UK respondents. In the Netherlands, there is clear confidence that the Eurozone will not greatly shrink in the next decade (only 17% envisage a significantly smaller EU). Most respondents, surveyed prior to the Greek elections, also believe it unlikely that a country will exit the Euro over the next 5 years. Only a quarter (26%) see this as likely.

In the UK, however, there is still nervousness about the Eurozone – 72% are bearish – and two thirds expect another Eurozone crisis in the next five years. An actual exit from the Eurozone by any country is seen as likely by 42%. In the UK, the Eurozone is still seen as the most likely source of a future crisis (46% hold this view, compared with 36% in the Netherlands).

Marcus Grubb, Managing Director for Investment Strategy at the World Gold Council, pointed to contradictory forces at work in the global economy. “The falling oil price has a disinflationary effect, boosting growth, but this is not necessarily the good news many assume it must be, because it lowers inflation rates at a time when Central Banks are struggling to maintain economic momentum. On the plus side however, there is a risk that interest rate rises will now be put off into the longer term, which is a positive, but may not be ideal longer term, as asset bubbles will continue to inflate. And yet a lower oil price could lead to possible deflation. It is a paradoxical situation” he says.

Marjon Wanders, co-founder of Eden McCallum in the Netherlands, notes “We’re seeing cautious optimism among our clients, with a renewed focus on growth and innovation.” Co-founder Heleen Wachters adds, “Most clients are concentrating resources on doing a smaller number of things well, while maintaining a contingency plan, which seems wise, given the uncertainty highlighted by recent developments internationally.”

Eden McCallum’s Economic Outlook Survey

Eden McCallum’s survey was conducted online with their network of clients and other business leaders. Responses were gathered 21-28 November 2014. There were 250 respondents to the Netherlands survey. 70% of respondents were Chairs, CEOs/MDs, Board Directors, divisional Directors, or VP/Partners, within publicly-listed companies (35% of respondents), privately-held companies (50%), state-owned entities (4%) and other types of organisation.