Business and Economic Outlook Survey – Q2 2024

Business leaders are guardedly optimistic about their future prospects, with an improved outlook when compared with six months ago. But uncertainties over geopolitics and the strength of future customer demand mean that there are no signs of euphoria breaking out in the C-suite.

These are among the key findings of the latest Eden McCallum biannual Business and Economic Outlook Survey. Just over 200 businesses in the UK, Netherlands and beyond were asked to share their views and expectations for the next one to two years. Their responses confirm that business leaders are feeling more optimistic, for now, but their hopes remain qualified.

Business and Economic Outlook

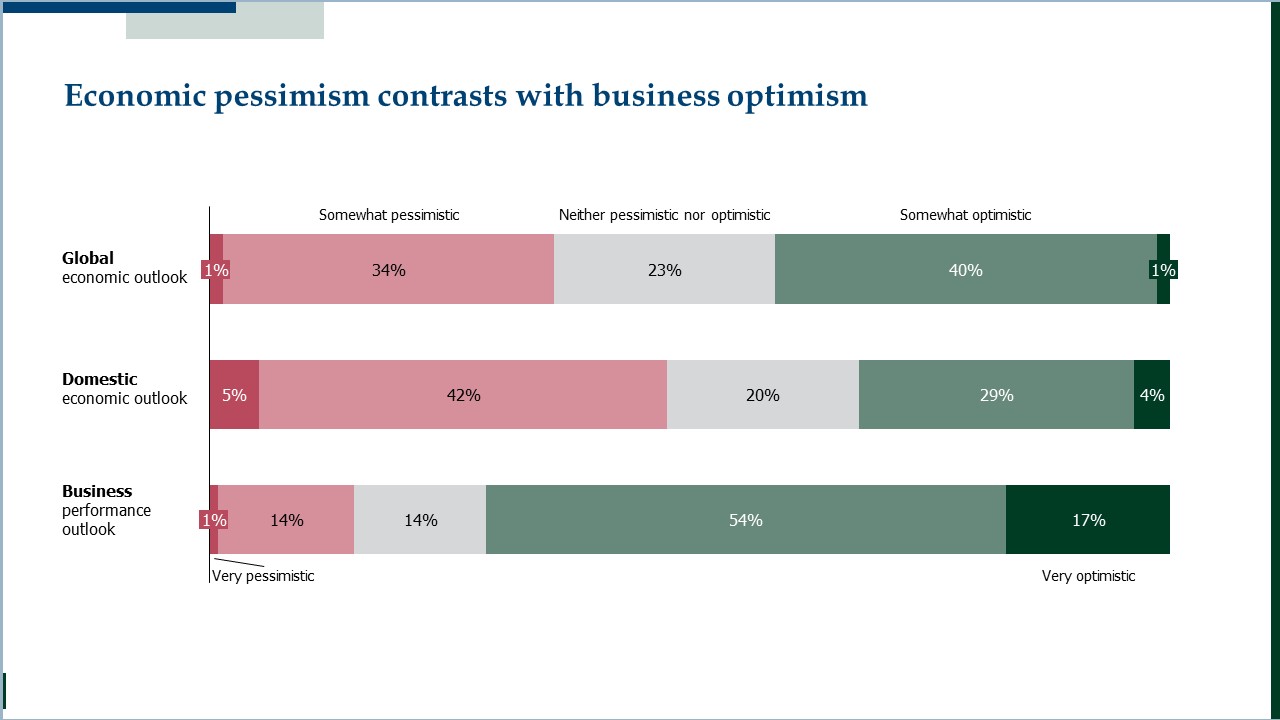

Pessimism has fallen sharply since the end of last year as far as prospects for the global and domestic economy are concerned. Yet 35% are still pessimistic about the global economy, and 47% of respondents are gloomy about their domestic economy. Business leaders remain positive about their own firms’ future: 71% are optimistic with only 15% expressing a pessimistic view.

There is a divide between the UK and the continent: 58% of British business leaders remain gloomy about their home market over the next one to two years, while only 33% of Dutch bosses share that view. However, UK domestic optimism has increased over the past six months, which appears largely due to a more positive expectation about inflation and a potential cut in interest rates.

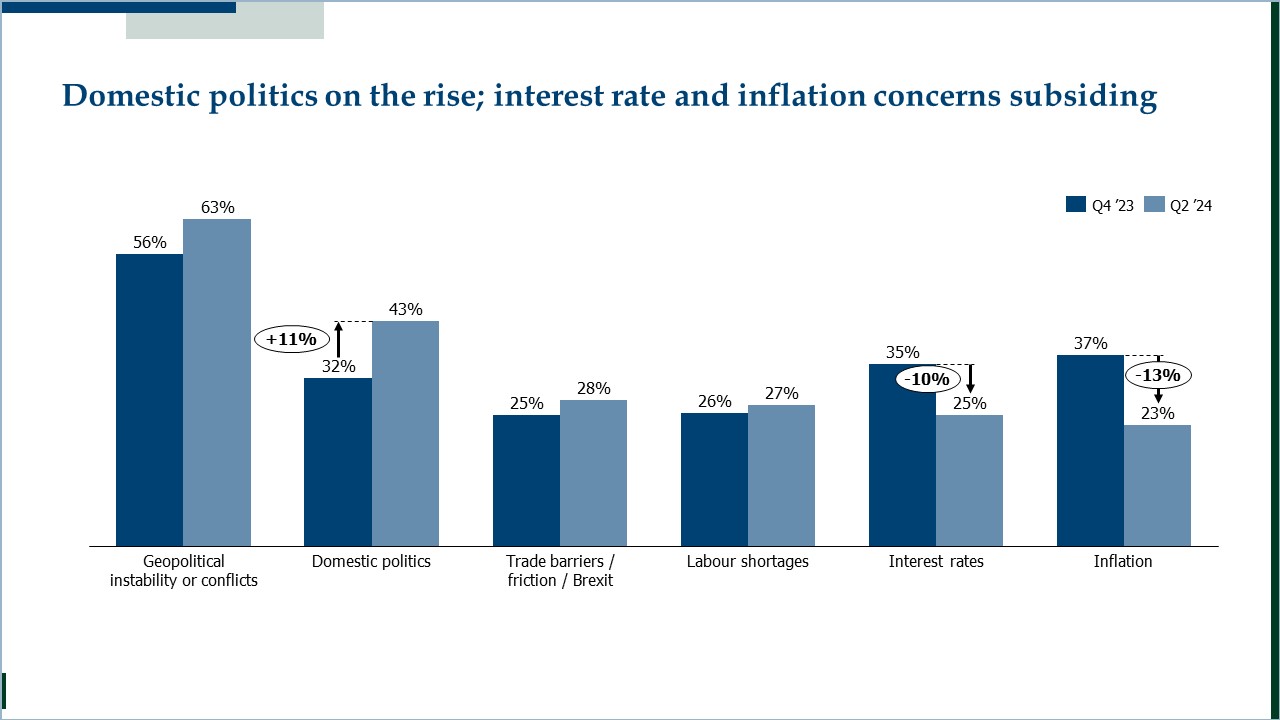

The biggest clouds on the horizon are geo-political instability (63% mentioned this) and nervousness over domestic politics (43%, with a marked rise in the Netherlands on this point following the recent general election). Other issues cited as potential sources of difficulty were trade barriers and Brexit-related friction (28% mentioned this) and labour shortages (according to 27% of respondents, with this again of particular concern among Dutch business leaders).

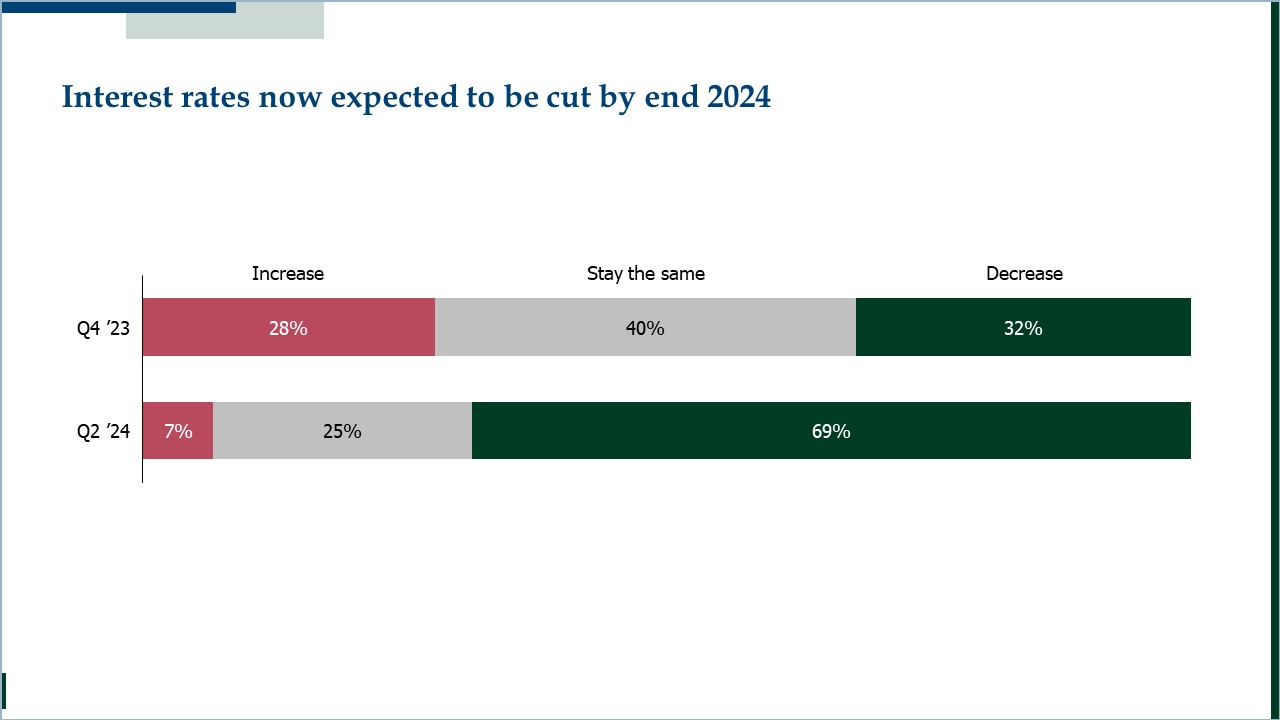

There are strong expectations for interest rate cuts among the survey respondents: over two in three business leaders expect interest rates to decrease by the end of 2024, compared with just under one in three six months ago. Two thirds of respondents also believe that inflation will reach target levels (2%) in 2025 or 2026, up from only a third of respondents in December last year.

Change in customer demand and geopolitical instability (cited by 37% in each case) remain the most important external factors likely to have a negative impact on company performance, according to our survey. There is increased concern about potential regulatory change even as worries over inflation and higher interest rates recede.

UK business leaders are more exercised about the threat of new entrants and competitors than they were at the end of last year, while Dutch business leaders are much more concerned about geopolitical instability and regulatory change.

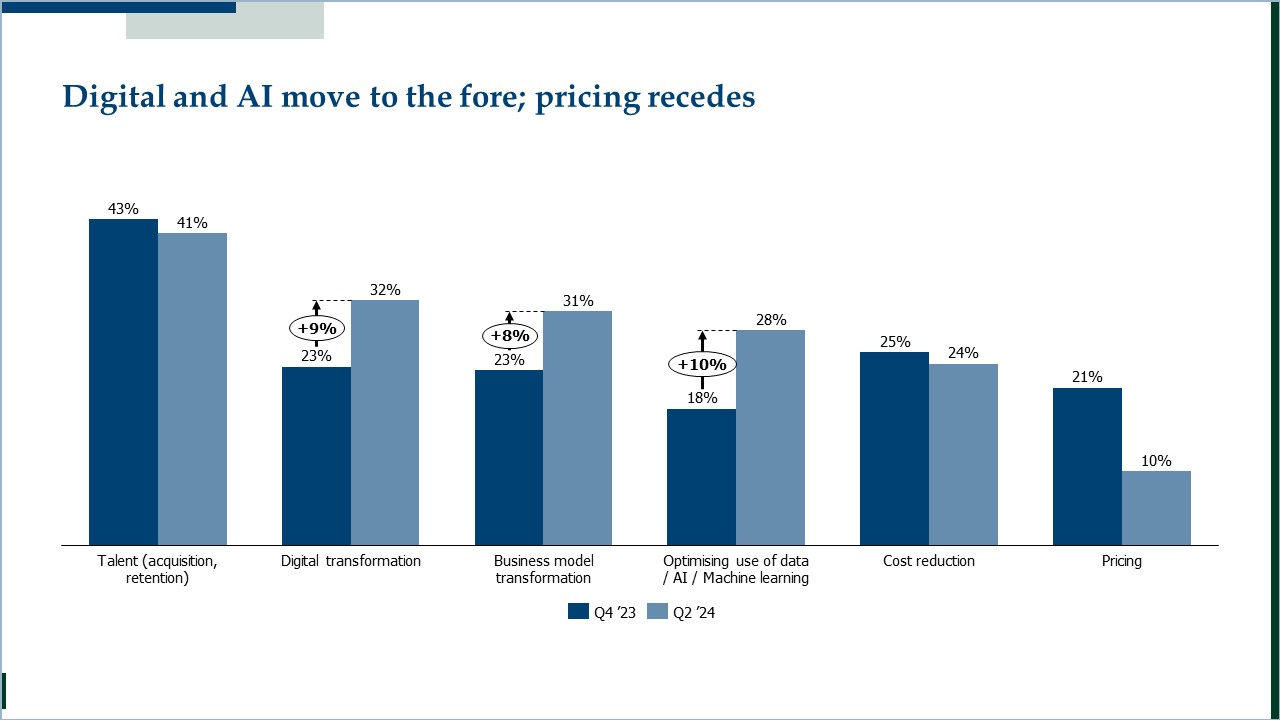

Talent remains the most important internal issue for all businesses, while digital transformation, business model transformation and optimising the use of data/AI/machine learning have increased in importance, and pricing has decreased in importance, since the end of last year.

Generative AI

As far as the emerging issue of generative AI is concerned, business leaders see it as having slightly increased in importance to their business/organisation since the end of last year, with four in ten rating it as currently important and six in ten rating it as important in the future (over the next one to three years).

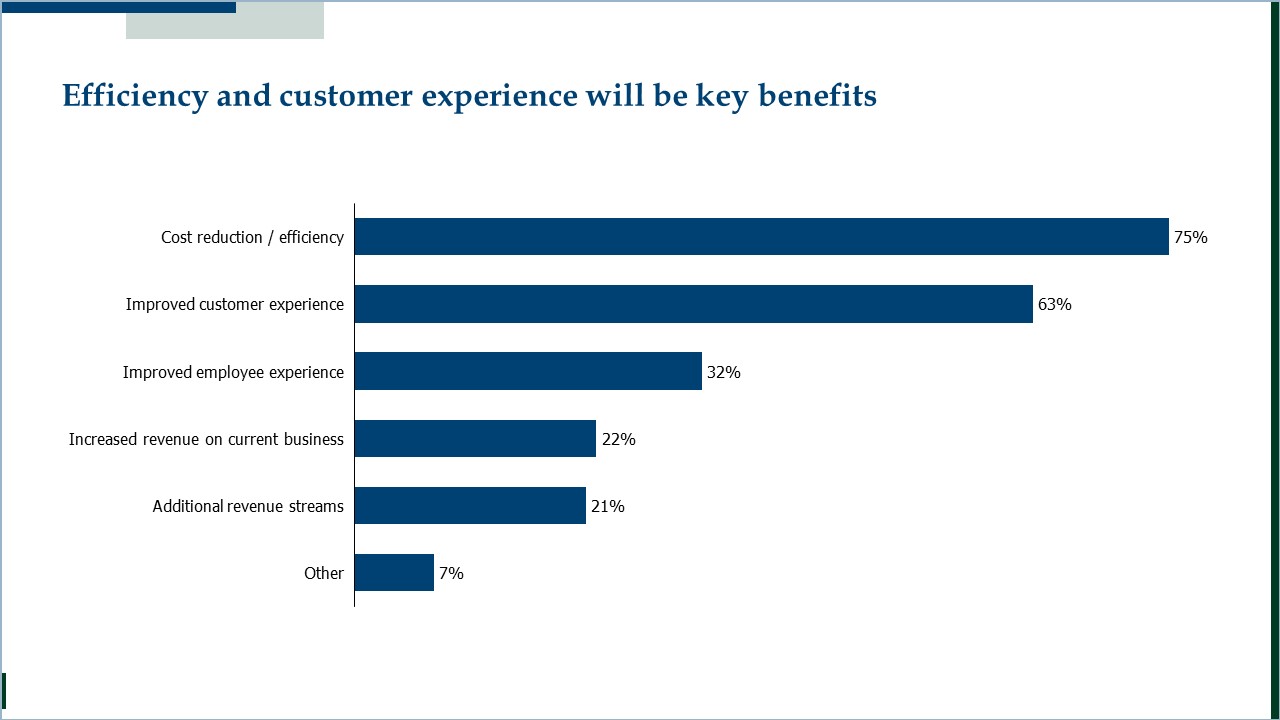

Most business leaders expect generative AI to drive value from cost reduction and efficiency (75% believe this), and improved customer experience (63% are of this opinion), while those who view generative AI as important also expect it to drive greater revenue and have higher expectations of employee and customer experience benefits.

Nearly half of the companies that currently view generative AI as important are now training existing staff, compared with less than a quarter a year ago. Companies that view generative AI as important in the future are twice as likely to be experimenting with it and are four times as likely to be training their staff to use it.

Ways of working

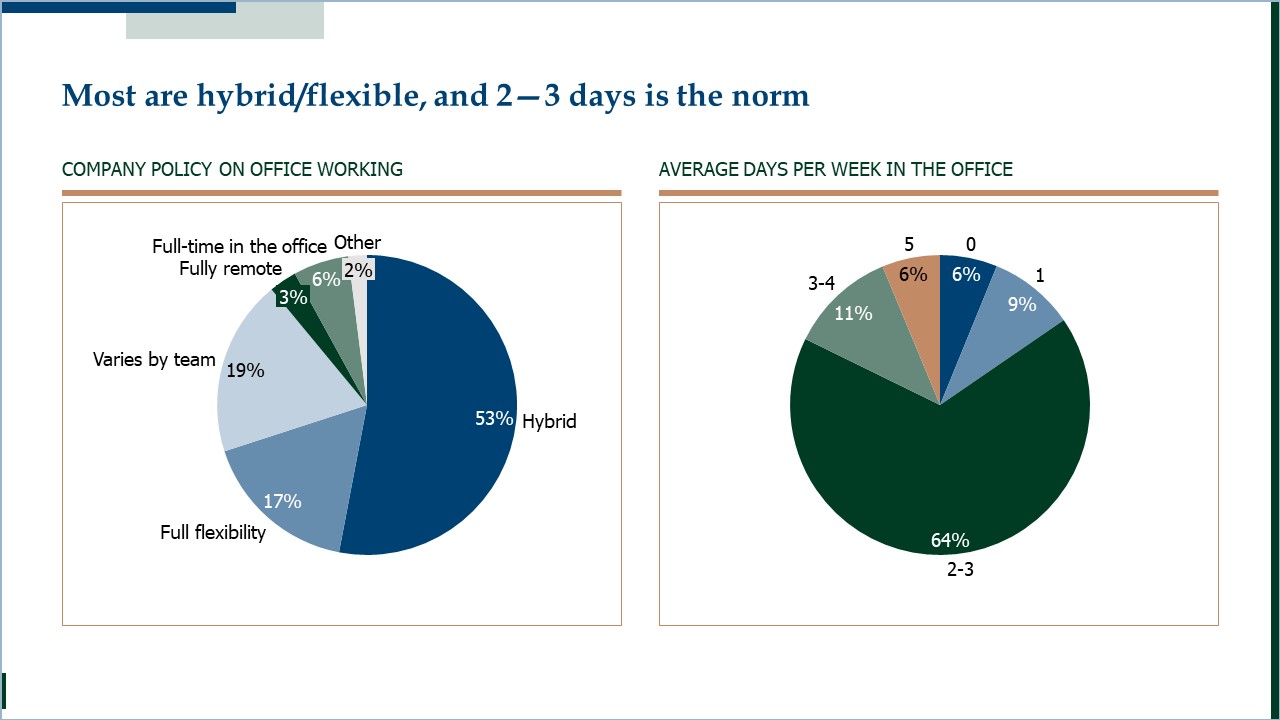

Most organisations (nine in ten) continue to operate a hybrid/flexible approach to office-based working, with less than one in ten working full-time in the office.

Most business leaders expect their organisation’s working from home practices to remain largely unchanged over the next one to three years (65% feel this way). Fewer respondents now expect there to be more office-based working in the future compared with six months ago (only 24% expect to see this, down from 29% at the end of last year).

Not too much has changed on the question of hybrid working. A steady-ish state of affairs has become established with 2 to 3 days per week in the office the norm – although a slight uptick towards 3 has been observed. Slightly more business leaders are now either fully remote or full-time in the office. Most leaders are satisfied with their organisation’s approach to office-based working, largely due to the view it gives workers the balance and flexibility they need; those who are dissatisfied are most likely to cite concerns about teamwork and productivity / efficiency.

Dena McCallum, co-founder of Eden McCallum, says that business leaders are displaying a kind of “sober optimism” as they look forward to likely trading conditions over the next couple of years. “While there is clearly relief that inflationary pressures are finally receding, and the chances of lower interest rates over the medium term look good, it is too soon to be celebrating,” she says. “Businesses remain under pressure, and the global outlook is uncertain. It is encouraging, however, that individual leaders seem optimistic about their own business’s prospects.”

To view the full results please click here and to follow us on LinkedIn to remain updated.