Managing the Covid-19 crisis: Continuing to navigate through

Businesses are preparing themselves for a longer, but in some cases a less dramatic, decline in activity compared to the early days of the crisis. This is a central finding from the latest Eden McCallum survey with UK office clients, into business responses to the Covid-19 crisis.

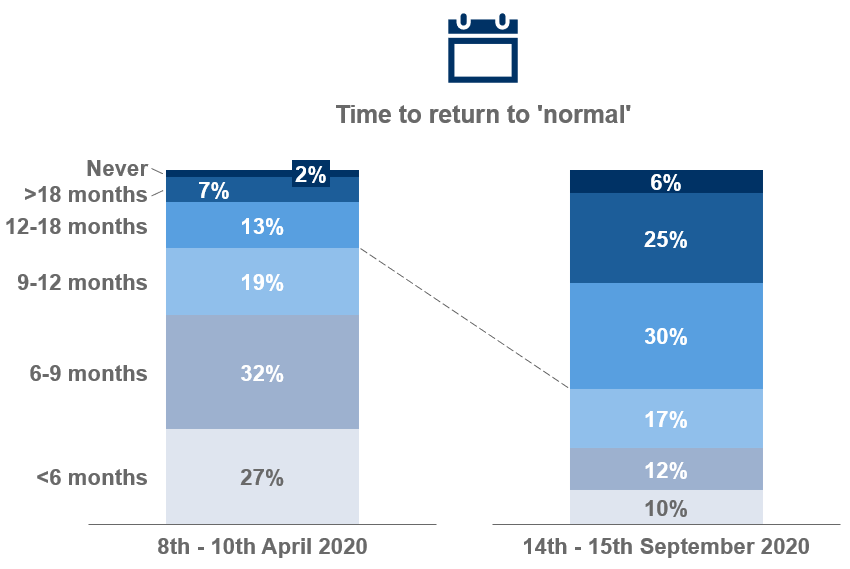

In mid-September, almost 200 businesses shared their views and experience of trading conditions. There has been a significant shift in sentiment since these surveys began five months ago. In April, only 19% of business leaders expected a return to “normal” to take more than a year. Now as many as 61% feel that way, up from 46% in July. This represents a rapid and steep decline in optimism about the recovery.

The gloom is not universal, however, and individual businesses retain some more positive feelings about the future. 40% of respondents still have positive expectations for their company’s performance in the fourth quarter, while 34% are feeling negative. But as far as the wider economy is concerned the mood is much less hopeful. Only 6% feel at all positive about the next three months, with c. 80% believing that the final quarter of 2020 is going to be very tough for their country’s economy overall.

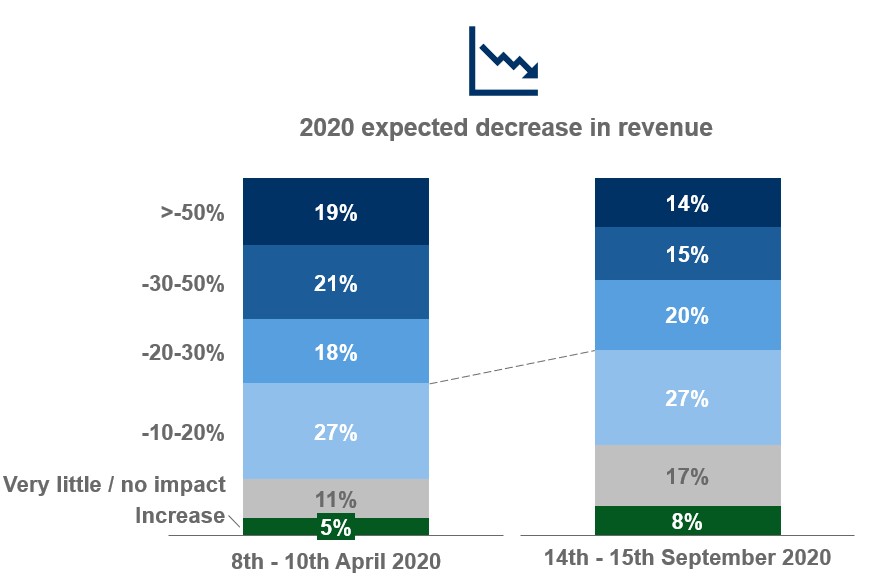

In general, revenue expectations have improved slightly, with just under half (49%) of respondents expecting a fall in more than 20% this year, an improvement on the 58% who expected that kind of fall in revenue in April.

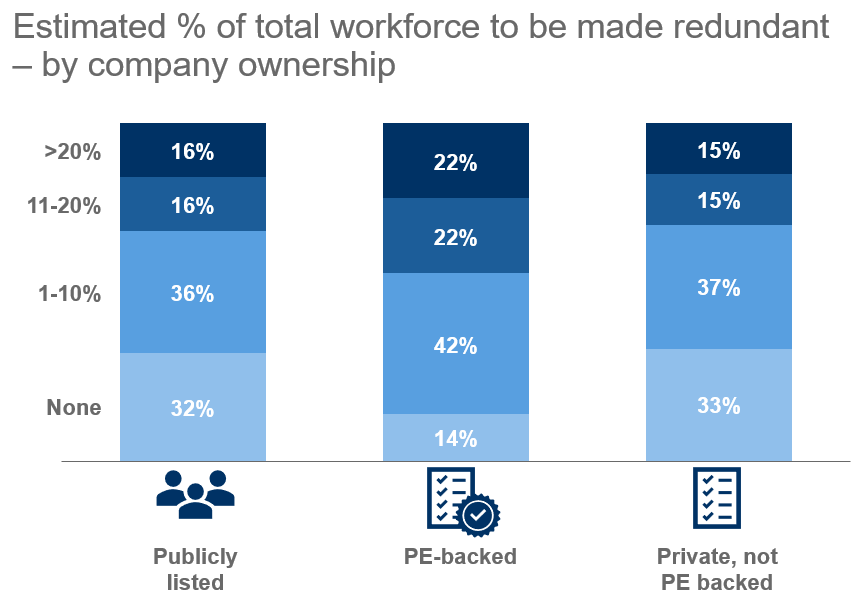

But more redundancies are coming: seven in ten businesses have already or plan to make staff redundant, a figure which has remained stable since July. It is noticeable that PE-backed companies are more likely to be taking action (86% are planning redundancies as against 68% of publicly listed firms).

In terms of working practices, two-thirds of companies were not requiring any employees to return to the office, even before recent announcements in response to the “second wave”. Fewer employees were also returning to the office than expected earlier in the summer: in July, 31% had expected less than 25% of workers to be onsite upon reopening; however, 61% actually had less than 25% of workers in offices in September at any one time.

There is also a divide in terms of ownership and a return to the office. Publicly listed companies had lower numbers of workers returning onsite: 71% had fewer than 25% of workers in offices in September, versus 55% for private companies. Almost half the business leaders surveyed were still working fully remotely, even before recent announcements. Those who had returned to the office said that social interaction and collaboration were the main benefits of being back.

Dena McCallum, co-founder of Eden McCallum, says these latest findings confirm that businesses need to restructure to see their way through the crisis. “In April, most thought that we would be ‘back to normal’ by the autumn. Businesses are now adjusting their planning horizons and making more fundamental changes to cope with the extended timelines that are now becoming the reality of this crisis. Some of the immediate actions – such as pay cuts and payment deferrals – are being reversed. But most businesses are now significantly transforming their operations.”

Other findings from the latest Eden McCallum survey include:

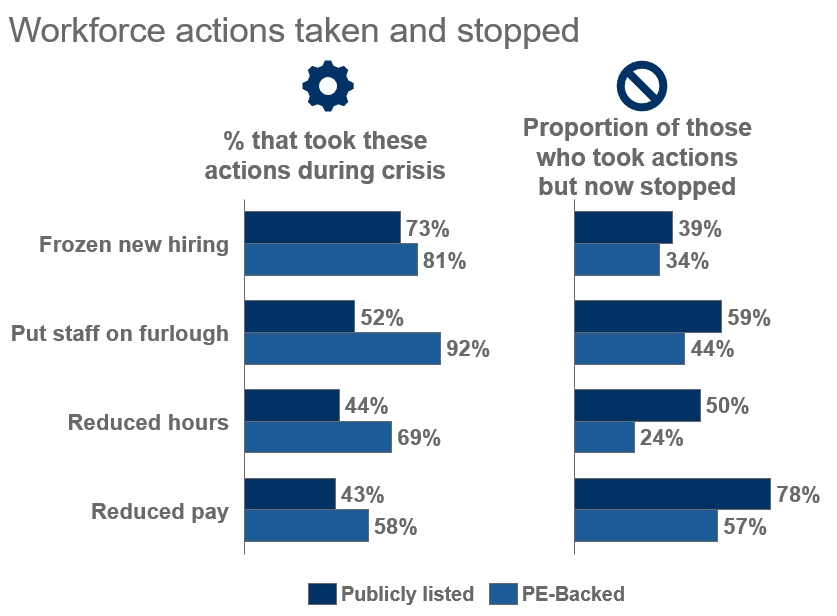

Companies have been slowly reversing previous cash-preserving workforce and other measures. Just over 40% of those who delayed supplier, rent and tax payments and more than 50% of those who used the furlough scheme and reduced pay are no longer doing so.

Publicly listed companies are the most pessimistic about the timing of eventual recovery. 73% expect “normal” to take over a year to return in contrast to 60% of PE-backed companies and 55% of non-PE backed private companies.

PE-backed companies carried out the most extensive range of workforce and non-workforce measures. While they have been stopping non-workforce measures at a similar rate to publicly listed companies, they have been slower to relax workforce measures, particularly reduced pay (57% who implemented this have stopped as opposed to 78% of publicly listed companies), and use of furlough (44% in PE as against 59% of publicly listed companies).

To view the full results, please click here and follow us to remain updated.