Opportunities for Swiss business in the era of Trump and Brexit

63% of Swiss business leaders surveyed are optimistic about the next 1-2 years

20% think Brexit will be good for the Swiss economy, 12% think it will be bad

25% think Trump will be bad for the Swiss economy, 14% think he will be good

A survey of 57 Swiss business leaders has revealed a mixed picture of attitudes as 2017 approaches. The Zurich office of Eden McCallum, the management consultancy, asked a number of bosses how they felt about trading conditions in the coming months and years. Parallel surveys were carried out by Eden McCallum in the UK and the Netherlands.

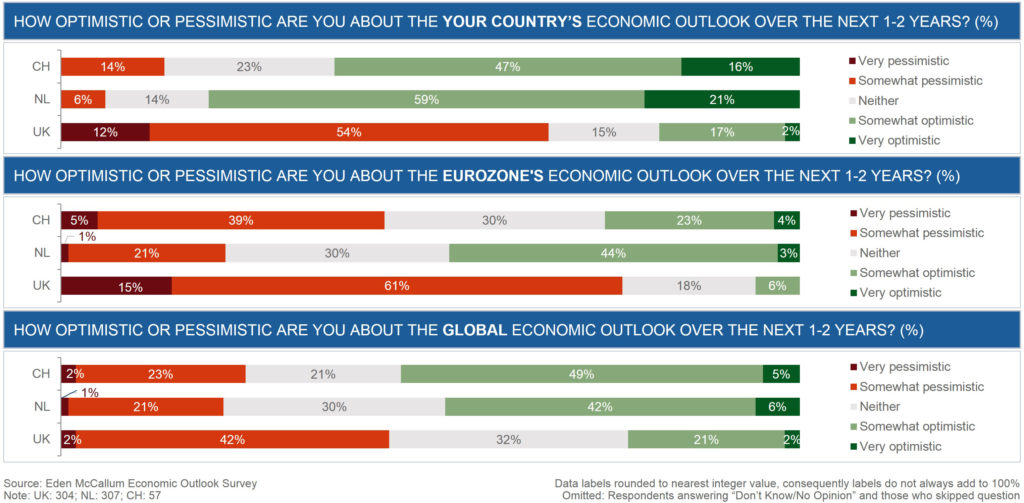

The Swiss survey showed that 54% of respondents remain optimistic about prospects for the global economy in the next 1-2 years, while 25% are pessimistic. And this optimism is also reflected in how they view Switzerland’s economic outlook: 63% are optimistic while only 14% have a negative view. Sentiment is decidedly gloomier among UK business leaders, who are feeling distinctly apprehensive about prospects for 2017 and 2018, according to Eden McCallum’s UK survey, with 66% pessimistic about UK economic prospects for the next two years. In contrast, Eden McCallum’s Netherlands survey revealed striking optimism about the prospects of their home market: 80% say they feel positively about the next two years, with 21% saying they are very positive.

Looking at the Eurozone economy, 27% of Swiss respondents are positive about the Eurozone’s prospects in the next 1-2 years, but 44% are pessimistic. UK respondents felt even less positive, with only 6% optimistic about the Eurozone’s economy and the large majority (76%) pessimistic. Dutch were more positive: 47% indicated they are optimistic about the Eurozone’s economic outlook and only 22% are pessimistic.

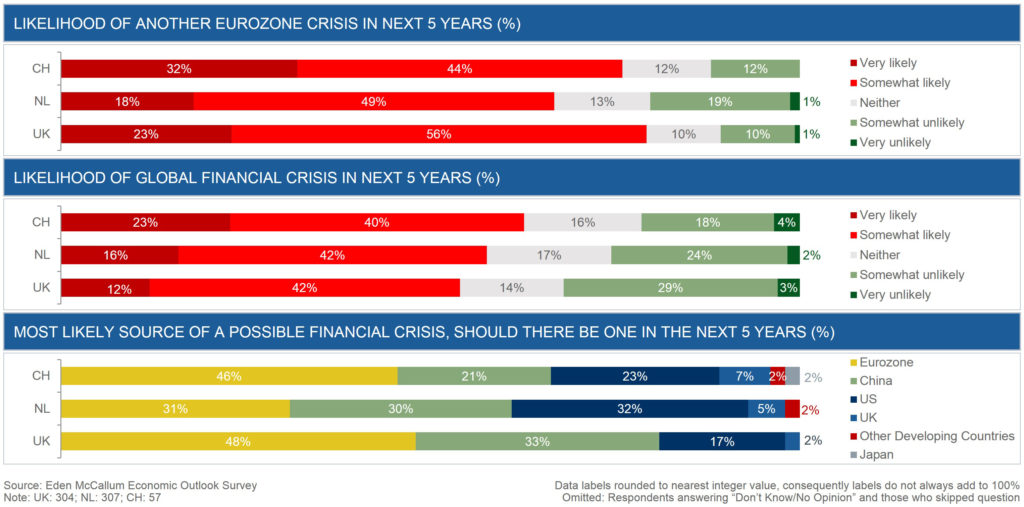

However, despite Dutch optimism, business leaders in all three locations agree that a further Eurozone crisis is likely to occur in the next five years (CH: 76%, NL: 67%, UK: 79%).

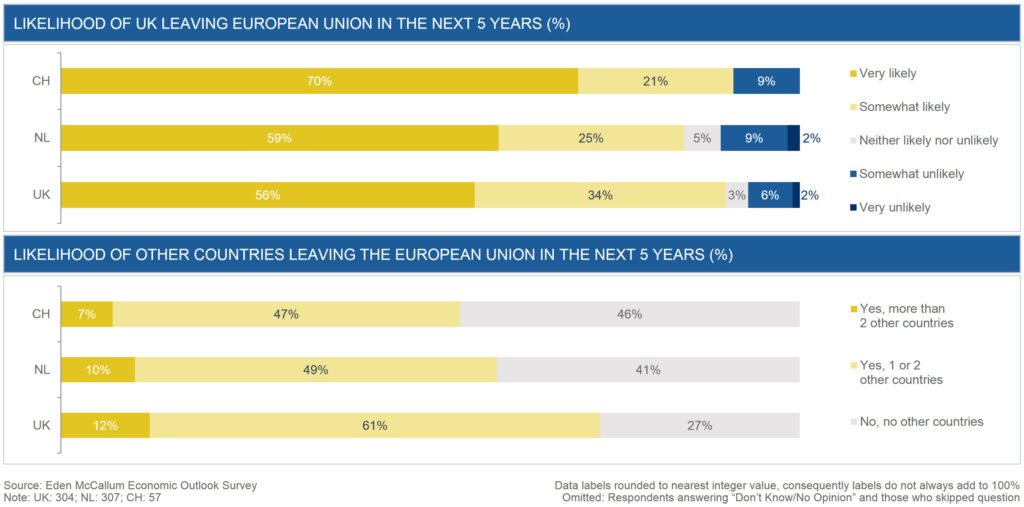

Turning to the subject of the impending Brexit, business leaders in all three countries think it likely that the UK’s exit from the European Union will take place in the next 5 years (CH: 91%, NL: 84%, UK: 90%), while the likelihood of other countries leaving the European Union in that same period is judged to be slightly lower (CH: 54%, NL: 59%, UK: 73%).

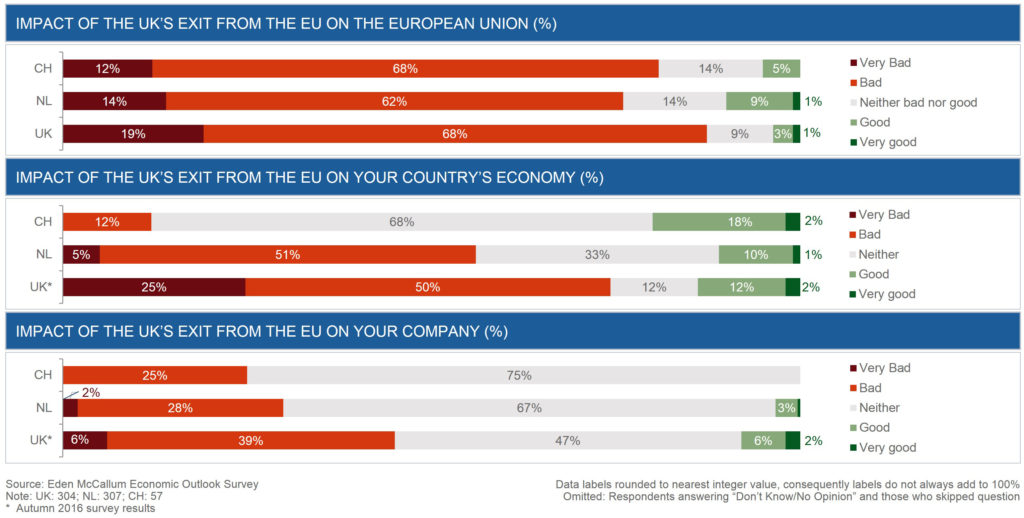

Interestingly, expectations of the likely impact of Brexit diverge between geographies: while business leaders in all three locations agree that the UK’s EU exit will be bad for the European Union (CH: 80%, NL: 76%, UK: 87%), a much smaller percentage expects a negative impact on their company (CH: 25%, NL: 30%, UK: 45%). Only 12% of Swiss respondents expect a negative impact on their country’s economy (compared to 56% in the Netherlands and 75% in the UK). What’s more, 20% of Swiss business leaders surveyed thought Brexit might have a positive impact on their country. As one Swiss business leader commented in the survey: “I believe Brexit could be good for Switzerland, since this opens up opportunities for flexible bilateral (or multilateral) agreements that could replace EU frameworks.”

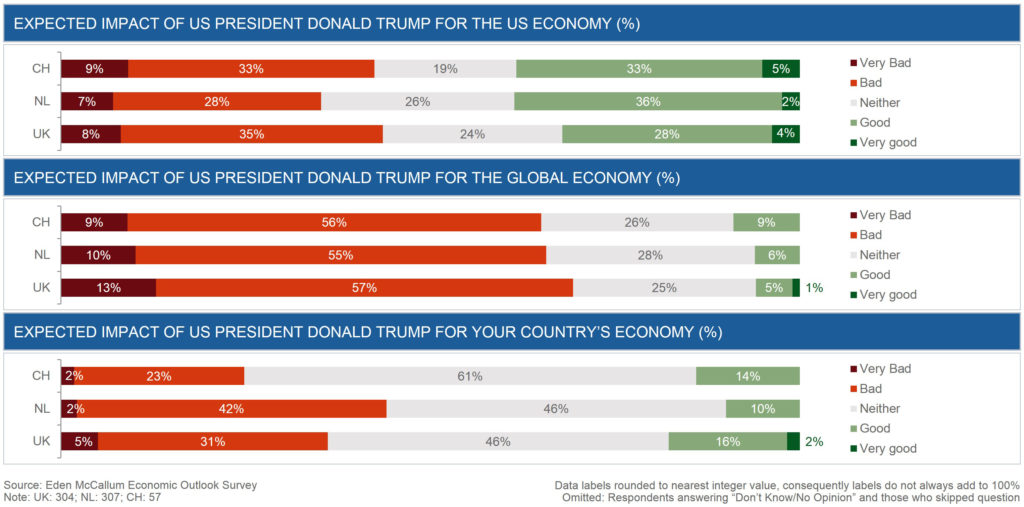

Returning to Swiss data, 65% of respondents think that Trump would be bad for the global economy, with only 9% believing he would have a positive impact. This view is largely shared by UK business leaders (70% negative, 6% positive) and their Dutch counterparts (65% negative, 6% positive).

Jörg Funk, managing partner at Eden McCallum Zurich, said: “It is encouraging that Swiss business leaders retain an essentially positive outlook for their own prospects as the new year approaches. But it is clear we are entering a period of uncertainty as far as the EU and the US are concerned. ‘Business as usual’ may not be an option, and Swiss bosses will have to be ready to adapt.”

Ends

Eden McCallum’s Economic Outlook Survey

Eden McCallum’s survey was conducted online with our clients and other business leaders. Responses were gathered between 16th and 30th November 2016 (after the US election and before the Italian referendum), and at the same time of year in 2013 (UK only), 2014 (UK and NL), and 2015 (UK and NL).

In 2016, there were 668 respondents (UK: 304, NL: 307, CH: 57). 79% of respondents were Chairs, CEOs/MDs, Board Directors, divisional Directors, or VP/Partners, within publicly-listed companies (41% of respondents), privately-held companies (49%), state-owned entities and other types of organisation (10%).