Eden McCallum Economic and Business Outlook Survey – Q4 2023

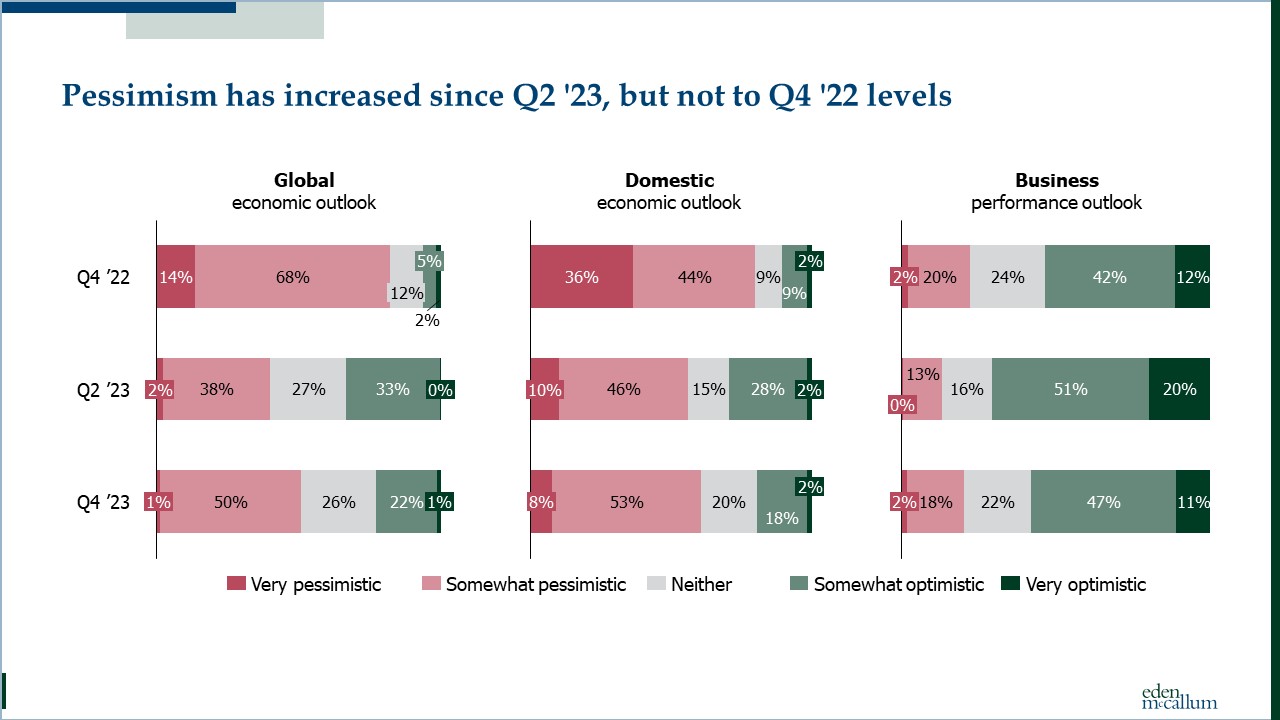

The message from central banks that interest rates will remain ‘higher for longer’ has landed, and that plus the troubling geo-political situation has led to a gloomier outlook in the latest Eden McCallum Economic and Business Outlook Survey. Our research has revealed that business leaders are notably more pessimistic about both their domestic and global economic prospects at the end of 2023 than they were six months ago.

The survey asked around 230 business leaders (mainly in the UK and the Netherlands but also around the world) about their expectations for the next one to two years. While the mood has picked up from where it was a year ago, this final quarter of 2023 has seen optimism fade from where it stood in the second quarter.

As seen in previous surveys, there is a contrast between the concern respondents have for the general situation and the more positive outlook that leaders have for their own businesses. While half our business leaders expressed pessimism about the global economy, and 61% were concerned about their domestic market, only 20% were pessimistic about their own company’s expected performance and six-in-ten were optimistic about their company’s future.

It is worth noting that a year ago as many as 82% of respondents were pessimistic about the global economy, and 80% were gloomy about their domestic market. Falling energy prices and improved supply chains, as well as the lack of recession in most large economies may have calmed the worst fears.

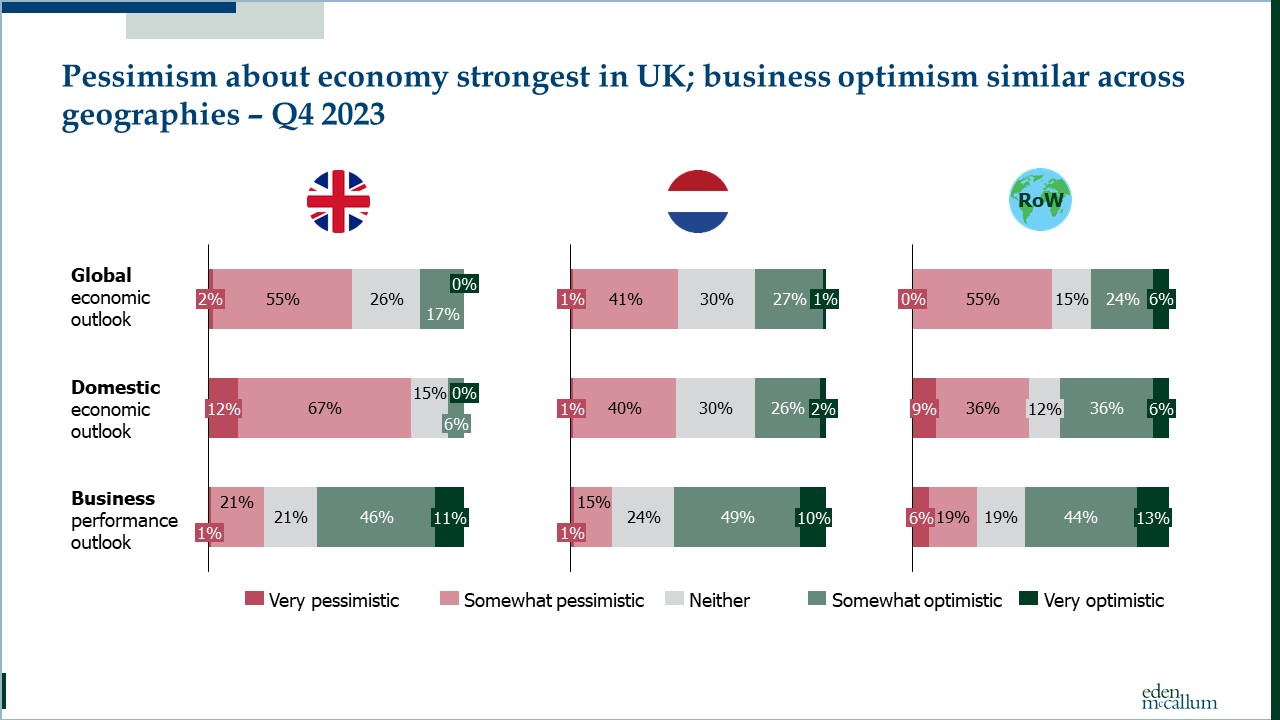

Optimism is in shorter supply in the UK than on the continent. 57% of UK business leaders are concerned about the global economy (only 42% of Dutch business leaders feel the same way). Eight-in ten UK businesses worry about the domestic economy, compared with 41% in the Netherlands. Stubborn UK inflation and higher UK interest rates may explain the heightened anxiety.

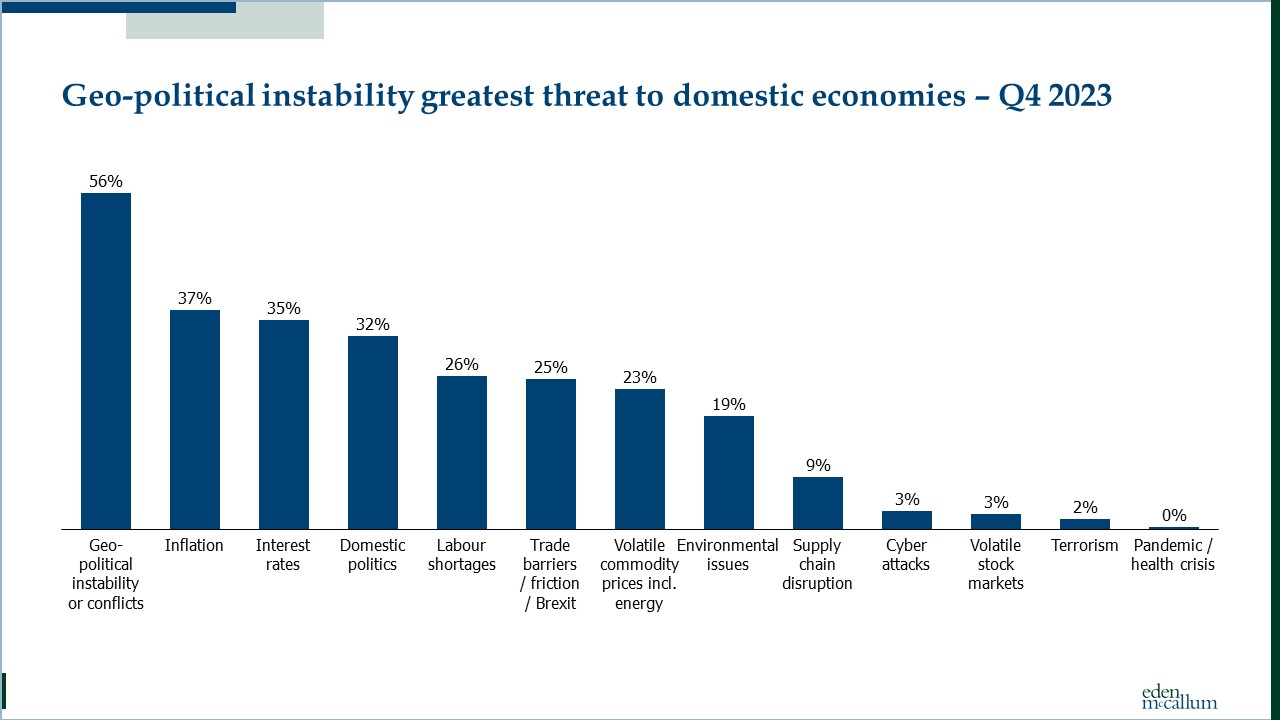

Geo-politics

In the wake of the October 7 attack on Israel and the subsequent bombing of Gaza – all while war continues in Ukraine and tensions rise between China and Taiwan – it is not surprising that 56% of respondents to this latest survey cite geo-political instability or conflicts as the greatest threat to domestic economies. Only inflation (37%), interest rates (35%) and domestic politics (32%) come close to being amongst the top three concerns that business leaders cited. Since Q2, concern about geo-political instability and interest rates has increased and concern about inflation and labour shortages has decreased.

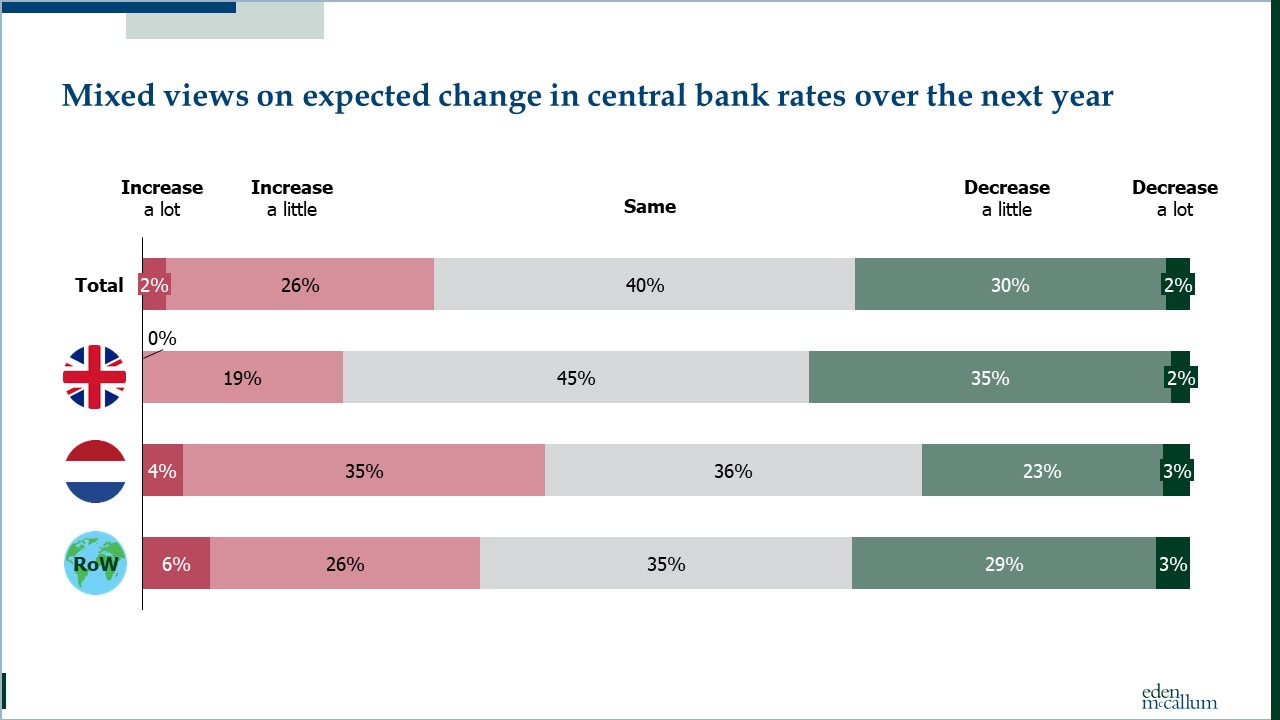

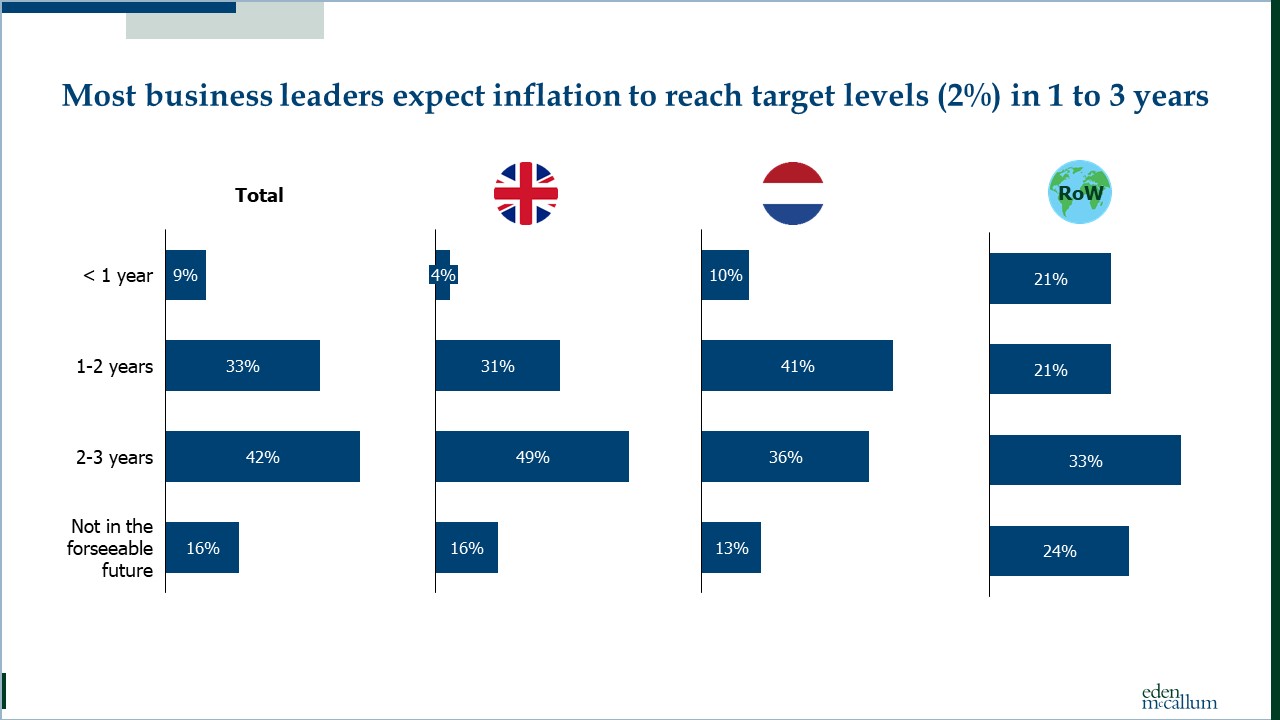

On interest rates, business leaders expect central banks to keep interest rates at the same levels over the next year, on average, with a decrease expected in the UK and an increase more likely in Europe. But only one in ten think inflation targets will be hit in the course of the next year (only 4% of UK business leaders believe this). The majority of respondents expect to have to wait two to three years before inflation targets are hit.

External factors

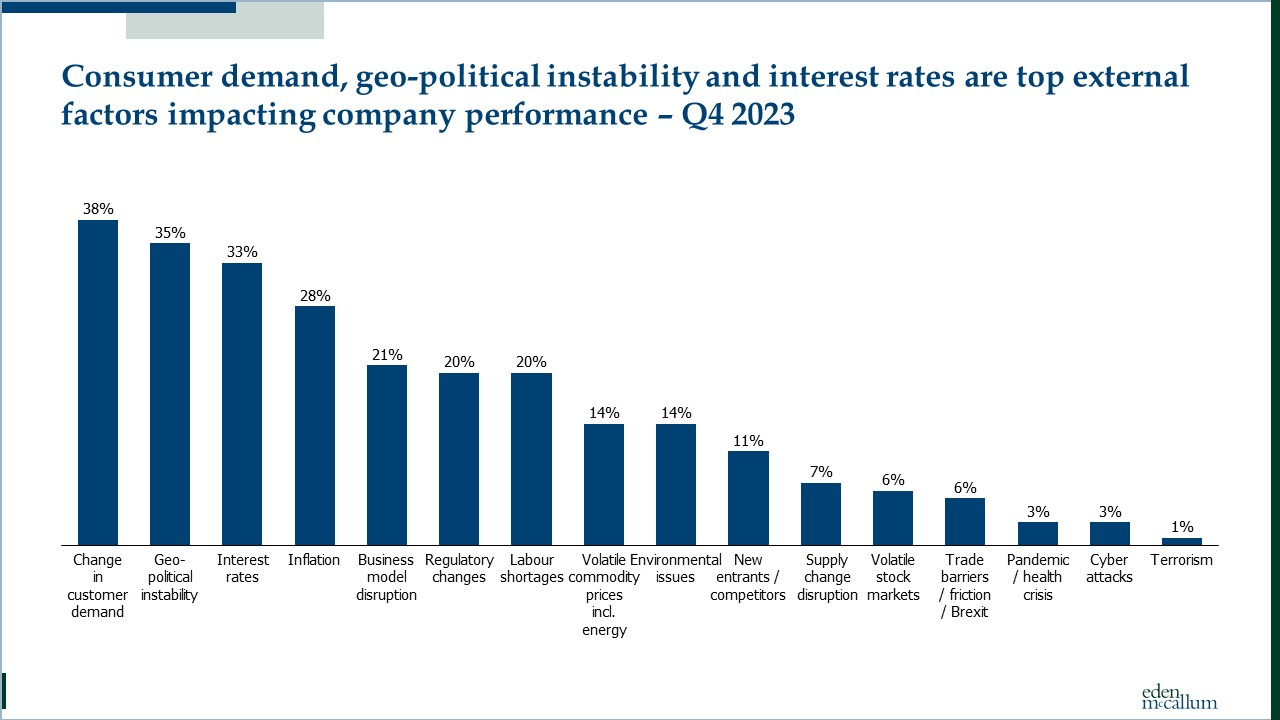

What are the external factors which business leaders see as most likely to have an impact on their company’s performance? Changes in customer demand (cited by 38% of respondents), geo-political instability or conflicts (35%) and interest rates (33%) feature most prominently on the concerns list.

Internal factors

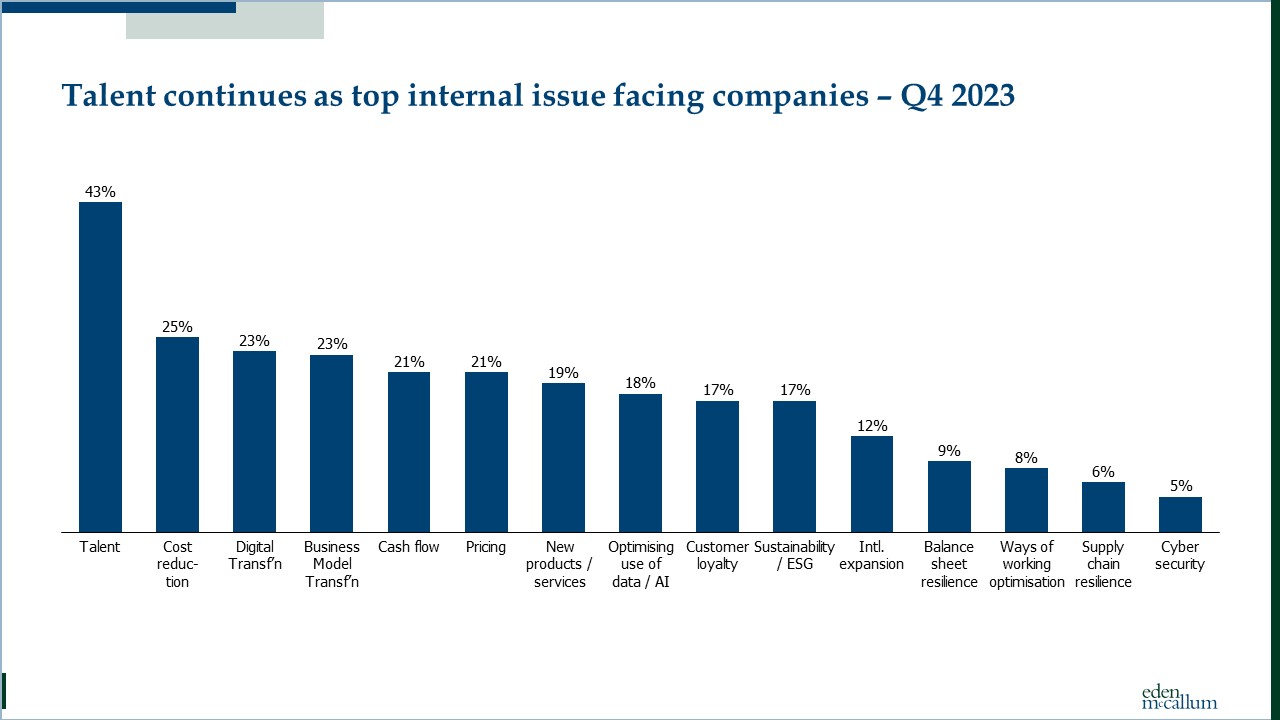

In terms of the internal issues which are occupying business leaders’ minds, talent remains by far the most significant. 43% cite talent retention and acquisition as their chief concern. Despite the worsening economy, unemployment remains low and skills and labour shortages remain. Cost reduction (25%), digital and business model transformation (both at 23%), cash flow and pricing (both at 21%) are the other main issues demanding leaders’ attention. These ratings have remained largely stable since Q2, with concern over cash flow being the only issue to increase in salience, with twice as many respondents mentioning it now compared with before.

Conclusion

Dena McCallum, co-founder of Eden McCallum, says that the sticky interest rate environment and the sombre global situation were bound to have an impact on the more hopeful attitudes registered in the survey six months ago. “Nonetheless, the fundamentals have improved from a year ago, and there are some signs of hope in terms of falling inflation and – eventually – moderating interest rates as well. Businesses will have to remain alert to shifting consumer sentiment as well as managing upward pressure on wages.”

To view the full results please click here and to follow us on LinkedIn to remain updated.